This is mark Joseph “young” blog entry #176, on the subject of Not Paying for Health Care.

I am not certain whom to blame for this; I don’t know whether it was a passing comment in conversation or a post in an online discussion or an article, but someone presented to me the suggestion that no one should ever be denied health care because he or she could not afford it. I also have the feeling that the word “entitled” was used, as in “everyone is entitled to receive needed medical care”.

It is a noble idea, but problematic.

I don’t know what you do for a living. Maybe you don’t. Maybe you sit home and collect government checks–and I mean no disrespect for that, as I know people who receive social security because they are too old to maintain a regular job, or disability because they are too infirm sometimes to get out of bed, and I think it a wonderful thing that we provide money to support these people. If we are supporting you because you are unable to support yourself, if you are a “burden on the taxpayers”–well, we the taxpayers have decided that it is worth a bit of our money to care for you. But odds are good that most of you “have jobs”, do something that brings in the money some of which goes through the government to those who do not work. We think that the elderly and the infirm are entitled to our support, and we use that word–entitled–athough usually as a noun, entitlements.

We also think such people are entitled to free and discounted medical care, which we also pay to provide. Our idea of what people need, and therefore that to which they should be entitled, keeps growing. People need, and are therefore at least in some places entitled to, cellular phones, Internet access, college education, transportation, and the list is growing.

I like the idea of entitlements; I’d like to be entitled. People need clothes. It would be nice if I could walk into a clothing outlet and help myself to jeans, shoes, shirts, socks and underwear, maybe a nice suit for special appearances. I’m not permitted to wander naked, and wouldn’t particularly want to do so anyway, so that makes clothes a need. No need to pay; I’m entitled. If you work in garment retail, don’t look at me–I get my clothes free.

I also need to eat; what if I can’t cook? Let me walk into a restaurant and order from the menu, have someone bring me food. I am entitled. If you’re the waitress, don’t expect a tip–I am entitled.

There isn’t a public bus within five miles of my home, and frankly almost everywhere I need to go, other than the hospital, is over there on the bus routes. Transportation is a need around here, and one for which the government provides for the elderly poor. Perhaps I should be entitled to a free ride whenever I want to go anywhere–call someone on my free phone and have them transport me to the store or the doctor or the movies, wherever I need to go, and then take me home again. The driver should provide this, because I’m entitled. Or perhaps I should just walk into a showroom and pick out my free car, and take it to the gas station for free gasoline.

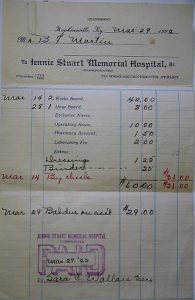

You get the idea. It would be nice if everything in the world were free, but then, who would pay for it? Medical care is not free in the sense that it has no cost. Even apart from whether drug companies are overcharging for medicines or whether hospitals, doctors, nurses, and other medical professionals are making too much money, medical care costs money. The drugs are made from materials through chemical processes that are not always simple, and in facilities that are designed to prevent contamination as much as possible–costs, even without the people. Patients are treated not only with medications, but with often very expensive diagnostic and treatment equipment (Computer Axial Tomography and Magnetic Resonant Imaging are very expensive, and are fairly standard in emergency room diagnostics). Again, facilities can be expensive as well. Much of the equipment is computerized. The machine which automatically takes your blood pressure costs more than a typical laptop computer, but in the long run saves money over having a person come into your room every fifteen minutes to do the job; the machine that measures the medicine as it goes into your arm is another small computer. Even the furniture is sophisticated–a hospital bed is capable of doing many things the typical patient is not aware that it does, and costs considerably more than most of the admittedly usually more comfortable beds patients have at home.

So maybe we’re overpaying the people–but what do we require of them?

If your doctor has been working for two decades, it is likely that his student loan debt still exceeds the amount you owed fresh out of college. Further, medical professionals–not just doctors–are required to take continuing education classes, to keep up with current knowledge in the field. Usually they have to pay for these classes. They also have to be recertified regularly in a host of areas, depending on their particular fields, from starting IVs to running a “code” (“Advanced Cardiac Life Support”), requiring classes and tests to ensure they know current best practice. Even so, medical knowledge is advancing so fast that it is said you are more likely to get the best care from a newly licensed graduate than from a seasoned professional with a decade or more of experience. Your doctor spends a substantial amount of his “free time” on continuing education for which he pays.

Because we allow patients to sue doctors, doctors also pay for malpractice insurance. It is likely that your obstetrician/gynecologist pays more for his malpractice insurance every year than the market value of his home. There is no easy fix for this–but that’s probably another article.

The point is, everything we give away “free” to anyone costs someone something–you can take money out of the equation entirely, if you like, but it still comes to the three basics of economics, land, capital, and labor, and that has to come from somewhere. We can give more of our money to the government and have the government provide more things “free”. Indeed, we can give all our money to the government and have the government provide everything “free”.

There is a name for a system in which everything is free. It’s called socialism. In its purest form, everyone of us works as hard as we can at whatever we can do, and every one of us is free to help ourselves to as much of everything as we can reasonably use. The pure form doesn’t work for the fairly obvious reason: if you were told that you can have as much as you think you need in exchange for working as hard as you think you can, just how hard would you work and how much would you need? Thus we have the practical form, in which someone is given the responsibility of overseeing how much you work and how much you take, in which you work as hard as your overseer thinks you can and take as much as your overseer thinks you need. When that’s a private sector system we call it slavery; when it’s run by the government we call it communism. Either way, if you want the government to provide everything free, you have to expect to pay for it somehow.

Of course, the people who say that medical care should be free don’t mean it should be free for everyone. They mean it should be free for those who can’t afford it. But then, who can afford medical care for calamitous conditions or events? Who gets to decide what you can or cannot afford? Does the fact that you own your house mean you can afford medical care up to the equity you have in your house, since of course you could sell the house and move your family to the street to cover the bill? If you own a small business, does that disqualify you from free medical care, even if it’s running in the red? Who gets free medical care? Who is entitled to it? Who has to scrape up the money for the bills or suffer for it?

Free medical care for everyone is a wonderful idea. It is also an expensive one, one that will cost every one of us a fair amount of money and may change the quality of our medical care going forward. If we want to go that direction, let’s at least consider ways to do so with the least amount of upheaval.

[contact-form subject='[mark Joseph %26quot;young%26quot;’][contact-field label=’Name’ type=’name’ required=’1’/][contact-field label=’Email’ type=’email’ required=’1’/][contact-field label=’Website’ type=’url’/][contact-field label=’Comment: Note that this form will contact the author by e-mail; to post comments to the article, see below.’ type=’textarea’ required=’1’/][/contact-form]